Will Medicare Part A Pay 100% of My Ben Taub Hospital Bill?

No, Medicare Part A does not pay 100% of your hospital bill at Ben Taub hospital.

It covers a significant portion, but there are out-of-pocket costs you need to be aware of. After you pay costs like deductibles and coinsurance, Medicare Part A will pay its share of your hospital bills.

Let’s dive deeper into what Medicare Part A covers and how it impacts the cost of healthcare services if you’ve been admitted to Ben Taub hospital in the Houston area.

Understanding Medicare Part A Coverage in Ben Taub Hospital

Medicare Part A is hospital insurance that helps cover inpatient care in hospitals, skilled nursing facilities, hospice care, and some home health care. However, it doesn’t cover everything, and you will have to bear some costs out-of-pocket.

Here’s a detailed look at what you can expect.

What Does Medicare Part A Cover?

Medicare Part A covers a substantial part of your Houston hospital bills, but you are still responsible for certain costs. These include:

- Deductible: In 2024, you must pay a $1,600 deductible for each benefit period before Medicare starts to pay.

- Coinsurance: After the deductible, Medicare covers the full cost for the first 60 days of inpatient care. For days 61-90, you will pay $400 per day, and for days 91-150 (lifetime reserve days), you will pay $800 per day.

- Beyond Lifetime Reserve Days: If you stay at Ben Taub hospital for more than 150 days in a benefit period, you will be responsible for all costs beyond the lifetime reserve days.

How Medigap Plans Can Help with Ben Taub Hospital Bills

Medicare Supplement plans, also known as Medigap, are designed to help cover the out-of-pocket costs associated with Medicare Part A. These plans can provide significant financial relief by covering expenses such as the Part A deductible and coinsurance payments.

How Medigap Plans Work

Medigap plans help cover costs that Original Medicare does not fully pay.

Here’s how they work:

- Covering the Deductible: Medigap plans can cover the Medicare Part A deductible, which is $1,600 per benefit period in 2024. This means you won’t have to pay this amount out-of-pocket if your Medigap plan includes this coverage.

- Coinsurance Payments: Medigap plans can cover the coinsurance payments for hospital stays beyond the initial 60 days.

- Days 61-90: $400 per day

- Days 91-150: $800 per day (lifetime reserve days)

- After 150 days, some Medigap plans offer additional coverage beyond this point.

Examples of Medigap Plans

Different Medigap plans offer varying levels of coverage. Here are some examples of plans that cover the Medicare Part A deductible and coinsurance:

- Medigap Plan F: Offers comprehensive coverage, including the Part A deductible and all coinsurance costs.

- Medigap Plan G: Similar to Plan F but does not cover the Medicare Part B deductible. It still covers the Part A deductible and coinsurance.

- Medigap Plan N: Covers the Part A deductible and coinsurance but requires copayments for some doctor and emergency room visits. These plans are typically less expensive than Plan F or Plan G Medigap plans.

Benefits of Medigap Plans for Hospital Bills in Ben Taub

Medigap plans can provide peace of mind by covering costs that Original Medicare does not fully pay, making your healthcare expenses more predictable and manageable.

Predictable Costs

By paying a monthly premium, you can avoid unexpected high medical bills, making healthcare expenses more predictable.

Comprehensive Coverage

Medigap plans can cover a wide range of out-of-pocket expenses that Original Medicare does not fully cover, such as deductibles and coinsurance.

Flexibility

These plans are accepted by any doctor or hospital that accepts Medicare, providing broad access to healthcare providers.

Conclusion

No, Medicare Part A does not pay 100% of your hospital bill. If you were recently admitted to Ben Taub, it covers a significant portion, but there are out-of-pocket costs you need to be aware of, such as deductibles and coinsurance. Understanding these costs and considering Medigap plans can help you manage your healthcare expenses more effectively if you are admitted to a Houston hospital.

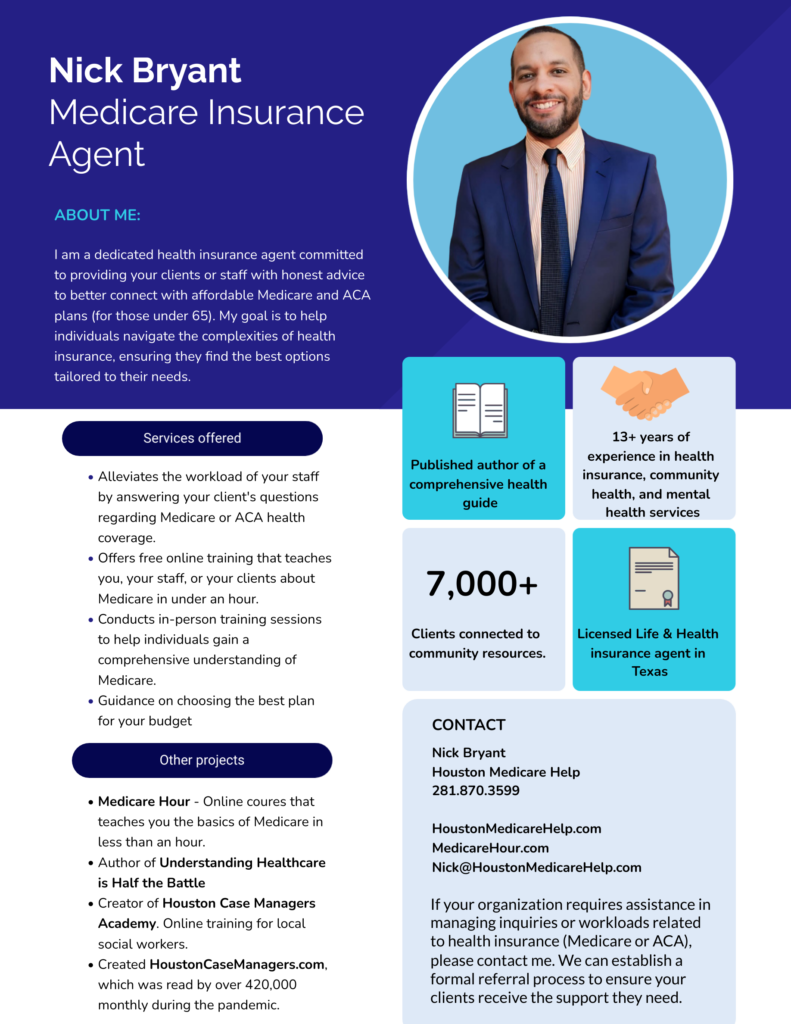

Whether you need help finding Medicare Supplement plans to help you with future Ben Taub hospital bills or you want to see if you can get a charity program to pay for past due medical costs I can help you. I’m a Medicare insurance agent and you can book a free consultation with me by either emailing me at [email protected] or scheduling your appointment here.