Are you trying to decide between Medicare Advantage and Medicare Supplements? Understanding the differences is crucial in making the best choice for your healthcare needs.

As a Houston Medicare agent, I often get asked about the differences between Medicare Advantage and Medicare Supplements.

In this article, I’ll explain the key distinctions to help you make an informed decision.

What is Medicare Advantage?

Medicare Advantage, also known as Medicare Part C, offers an alternative way to receive your Medicare benefits. Private insurance companies provide these plans, which include all the benefits of Original Medicare (Part A and Part B) and often additional benefits like vision, dental, and prescription drugs.

Pros of Medicare Advantage

- Comprehensive Coverage: Many Medicare Advantage plans include additional benefits that Original Medicare doesn’t cover.

- Cost-Effective: These plans often have lower premiums than Medicare Supplements, though you may have to pay more out-of-pocket for certain services.

- Convenience: Medicare Advantage plans can offer a one-stop-shop for all your healthcare needs, including prescription drug coverage.

Cons of Medicare Advantage

- Network Restrictions: You typically need to use doctors and hospitals within the plan’s network, which can limit your choices.

- Variable Costs: While premiums may be lower, copayments, coinsurance, and deductibles can add up, especially if you need frequent medical care.

What are Medicare Supplements?

Medicare Supplements, also known as Medigap, are policies that help pay for costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles. These plans are sold by private insurance companies and can be added to your Original Medicare coverage.

Pros of Medicare Supplements

- Predictable Costs: With a Medigap policy, you have more predictable out-of-pocket expenses, which can make budgeting easier.

- Flexibility: You can see any doctor or specialist that accepts Medicare, without worrying about network restrictions.

- Comprehensive Coverage: Medigap plans can cover most of the out-of-pocket costs associated with Medicare, providing peace of mind.

Cons of Medicare Supplements

- Higher Premiums: These plans typically have higher monthly premiums compared to Medicare Advantage plans.

- No Additional Benefits: Medigap plans do not include extra benefits like vision, dental, or prescription drug coverage, so you may need separate policies for these.

Which Should You Choose?

The decision between Medicare Advantage and Medicare Supplements depends on your individual healthcare needs and financial situation. Here are a few considerations to help you decide:

- Budget: If lower monthly premiums are a priority and you’re okay with potential out-of-pocket costs, a Medicare Advantage plan might be right for you. If you prefer predictable costs and are willing to pay higher premiums, consider a Medigap policy.

- Healthcare Needs: If you require frequent medical care or prefer the flexibility to see any doctor, a Medicare Supplement might be the better choice. If you like having additional benefits like dental and vision included in your plan, Medicare Advantage could be more suitable.

- Lifestyle: If you travel frequently or live part of the year in another state, a Medigap plan might offer better coverage options since you can see any provider that accepts Medicare.

Conclusion

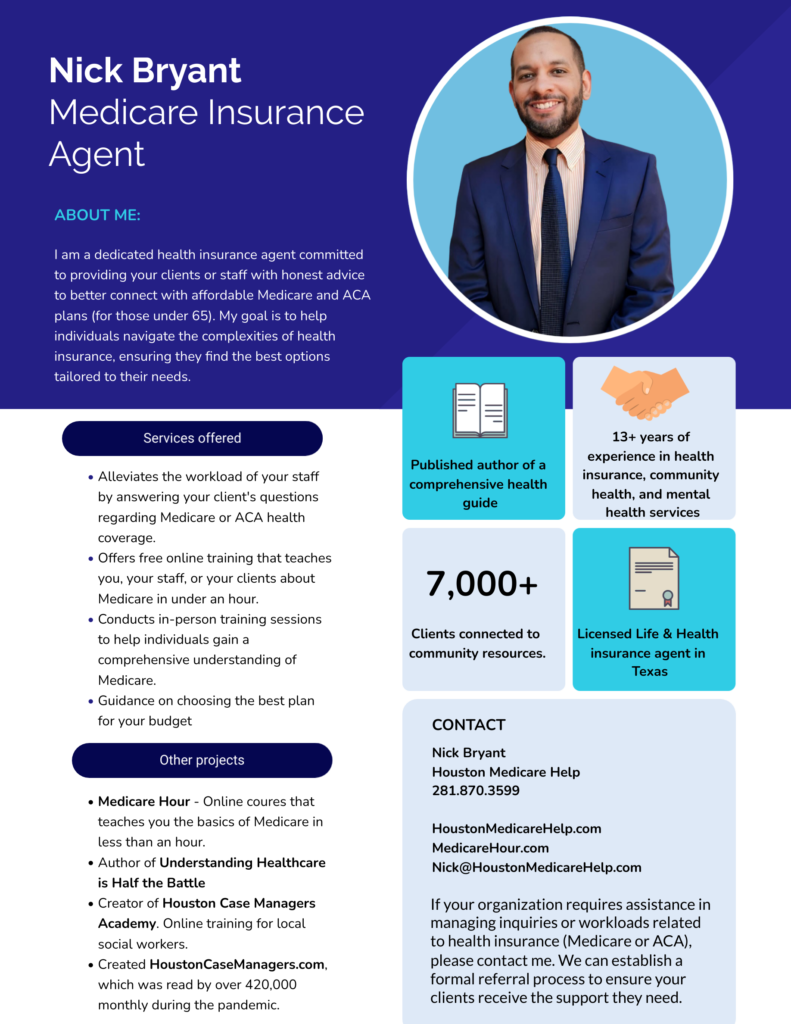

Choosing between Medicare Advantage and Medicare Supplements can be challenging, but understanding the differences can make your decision easier. As a Medicare broker in Houston, I’m here to help you navigate your options and find the plan that best suits your needs.

For personalized assistance, feel free to contact me, Nick Bryant, at 281.870.3599 or email [email protected]. Let’s ensure you get the coverage you need for a healthy and secure future.